Rocketplace, a startup that aims to build a “next-generation asset management platform for crypto,” has raised $9 million in a seed funding round.

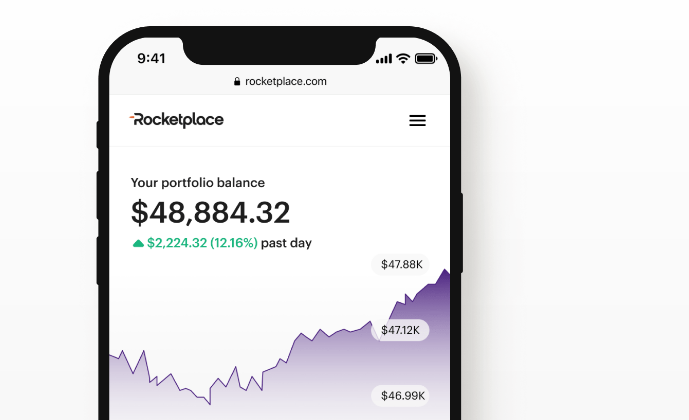

A few things about this raise stood out. For one, the funding comes at an interesting time in the crypto world — during the so-called “crypto winter” and a period that has seen other major players in the space such as Voyager and Celsius go bankrupt and others such as Robinhood and Coinbase conduct mass layoffs. Secondly, Rocketplace — which offers commission-free trading of more than 30 tokens — claims to “not be just another crypto exchange.”

Currently, Rocketplace has 10 employees, and it plans to use its new capital in part to double its team over the next six months. The majority of the capital will go toward launching its fund distribution business.

A key part of the Rocketplace vision is the human aspect of crypto — making the asset class more approachable, intelligent and transparent. While most crypto platforms are designed to be transactional in nature, Rocketplace was built to offer a holistic, user-first experience. The Rocketplace team has the opportunity to build an enduring brand akin to Fidelity or Charles Schwab in traditional financial services.